Table of Content

Web banking is generally available for both individuals and small businesses. Some users may be more comfortable with web banking than new apps for mobile phones. The vast majority of web browsers are also open source and thoroughly tested, which makes them more secure than most mobile apps. Amid rising interest rates and muted investment returns, lenders have seen an increase in part pre-payments and loan balance transfers by home loan borrowers, especially in metro cities or from high end customers. All transfers, and/or fees as described in your services agreement with us and made through the Service will appear on your monthly Account statement.

Any of your deposit accounts with us must be current or in good standing. Transfers are available only for consumer accounts and for personal, family or household purposes. Customer Acknowledgement.Customer understands that any action taken pursuant to this Agreement will be conducted by electronic means or methods which comply with the operating and security procedures applicable to this Service.

Explore digital banking

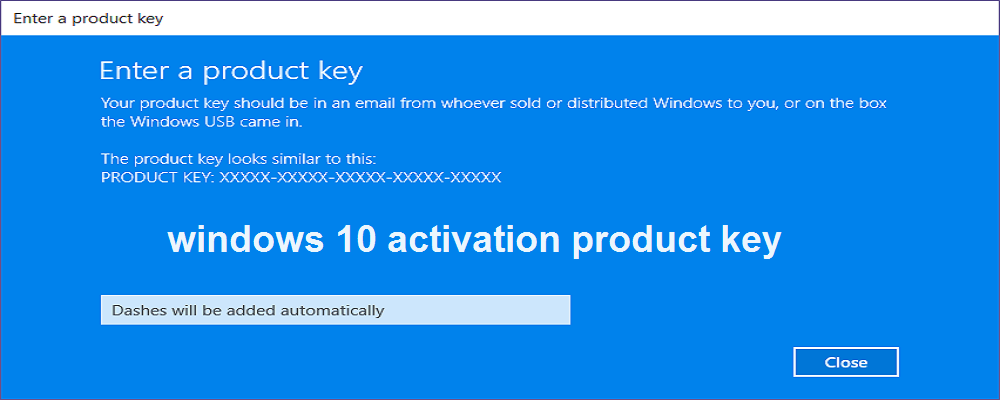

We reserve the right to change, suspend, or discontinue the Service, in whole or in part, or your use of the Service, in whole or part, immediately and at any time without prior notice to you. You may also discontinue your use of the Service at any time. The Bank is not responsible for any third party hardware or software you may need to use the Service. Any such hardware/software is subject to the terms and conditions of the hardware/software agreement with the third party software provider of the hardware/software for your use.

Therefore, the site may offer a different privacy policy and level of security than the HomeTrust Bank web site. While we believe this source is reliable, the HomeTrust Bank does not endorse or guarantee the content, products or services offered by the site, and the site is responsible for its web site content and system availability. Service Availability.The Service is generally available 24 hours a day, 7 days a week.

Explore personal banking

A home loan balance transfer is a fantastic option for people who have taken a loan, yet few take advantage of it. The home loan transfer process is effective and should be used by everyone who has taken a home loan. Transfer money between your HomeTrust accounts and accounts you own at other financial institutions using either a Standard 3-Day or a Next Day delivery speed1. Home Bank does not charge a fee for transferring funds into or out of your Home Bank personal accounts through Online Banking, regardless of the delivery speed you choose. Any transfer initiated on a day that is not a business day as described in Section 11 begins processing on the following business day and counts toward the applicable dollar limit for the next business day.

An inside sale happens when customers are sold products and services through the phone or online rather than at the vendor's physical location. Although there are cybersecurity risks related to home banking, they are generally less serious than the physical risks of banking in person. If you'd like your money to be transferable to and from both accounts, please fill out two forms . Please note, only primary members may authorize this service. Once processed, you'll be able to transfer money by following the directions on the Bank IT-Transfer Funds screen in Virtual Branch Home Banking. The contents of this article/infographic/picture/video are meant solely for information purposes.

Welcome Home to Banking your way.

Spoofing is a scam in which criminals try to obtain personal information by pretending to be a legitimate business or another known, trusted source. However, home banking can also expose users to cybersecurity risks. Charles is a nationally recognized capital markets specialist and educator with over 30 years of experience developing in-depth training programs for burgeoning financial professionals.

Use of the Service is expressly conditioned on your acceptance of this Agreement. By using the Service you acknowledge that you have read and agree to abide by the terms and conditions as stated herein. If you do not agree to the terms and conditions stated herein, you may not use the Services.

Don't worry about making a trip to the bank. Make deposits with your mobile device.

Select how frequently you’d like transfers to occur (every ‘x’ number of weeks or months). Under ‘Amount’, type in the amount of money you want to transfer. Receive e-mails informing you of the status of your transfers.

Transfers To Transfer funds using a mobile or desktop Browser, choose Transfer from the Dashboard Menu. Click Here to see instructions on how to make a transfer using the Mobile App. Contact one of our friendly customer service representatives. With Online Banking Transfer, submitting your Texas Trust payments has never been easier. Other restrictions may apply; contact your financial institution with questions. Set up a savings or stock-purchase plan and stick to your goals by making transfers automatic.

But funding transfers with a debit card, credit card, or PayPal credit may result in fees. Businesses may also have to pay PayPal to receive payments from customers. It is your responsibility to verify with the external financial institution any restrictions regarding transfers to or from any External Account that you enroll. If you’re an owner of both bank accounts, a basic bank-to-bank transfer is a good option. You can set up the transfer with the sending or receiving bank, and the funds arrive at the destination after two or three business days. The timing ultimately depends on which banks you use and whether you are moving money internationally or domestically.

Most mobile apps are easier to use than websites, and they have some security benefits. In particular, banking apps can provide protection from phishing attacks. Mobile apps also often allow users to access features that are not available via websites. For example, it is frequently possible to scan paper checks with an app, while this feature is less common on websites.